It has been quite hot lately, right? At Aurum Impact, we have spent a great amount of time exploring carbon dioxide removal (CDR) and its role in climate change mitigation. It is a rapidly evolving industry that we are excited about. Let us take you through our perspective on the sector by looking into 1) the need for CDR, 2) CDR options, 3) CDR demand, 4) levers for scaling CDR, and 5) our CDR wish list.

1. Why do we need CDR?

CDR is defined as human activity that removes carbon dioxide (CO2) from the atmosphere and durably stores it in geologic, terrestrial, or ocean reservoirs, or long-lived products (e.g., concrete).1

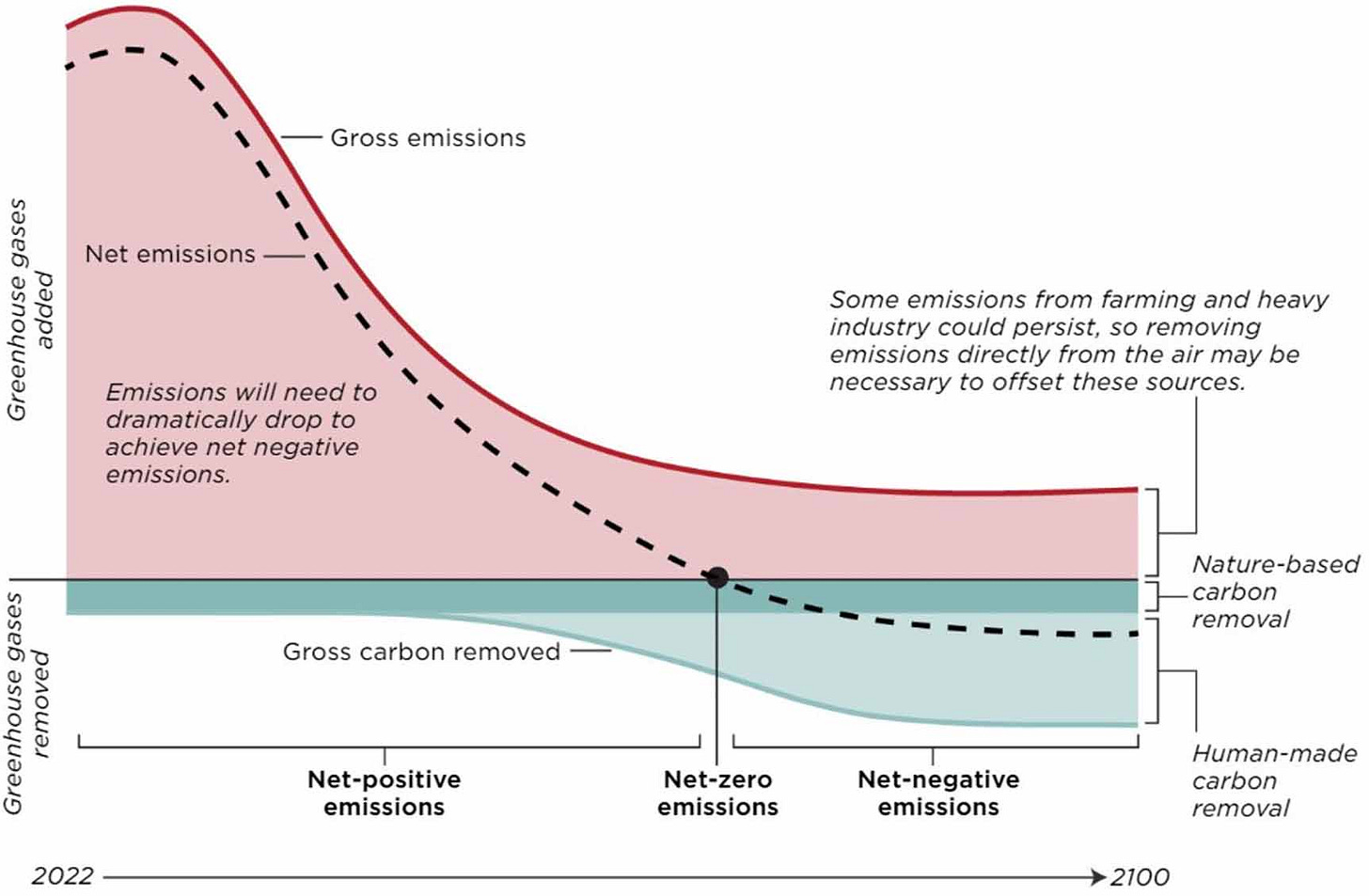

In an ideal world, there would be no need for CDR. Unfortunately, we have emitted so many greenhouse gases that limiting global warming to 1.5°C without removing carbon dioxide from the atmosphere will be impossible. CDR is part of all modeled scenarios that limit global warming to 2.0°C or lower by 2100.2 Of course, it cannot substitute for deep emissions reduction and must be understood as an addition to it. It is necessary to 1) counterbalance residual emissions for net-zero by 2050 and 2) achieve net-negative emissions after that as illustrated below.

Graph: CDR in a stylized pathway of 1.5°C climate action reaching net-zero emissions by 20503

Starting on the left of the graph, global net greenhouse gas emissions were 57.4 Gt CO2e in 2022. Existing carbon removal (e.g., trees) absorbs ~2 Gt CO2 annually. It is called nature-based carbon removal in the graph (see the mint green block). We need rapid net emissions cuts throughout the next years to achieve net-zero emissions in 2050 (follow the dashed black line). As there are likely to be some unavoidable residual emissions (e.g., from heavy industry) at that time (red line), we need human-made CDR so that there will be enough gross carbon removal (mint line) to counterbalance those. Human-made carbon removal includes all forms of carbon removal (e.g., also afforestation). It is used as a term for the graph to show that the carbon removal needs to be additional (i.e., coming from human activity) to what we already have. According to the independent scientific assessment “The State of Carbon Dioxide Removal”, the central range for total CDR deployment required for climate targets is 7 to 9 Gt CO2 annually by 2050. This is equivalent to 12% to 16% of emissions in 2022.4

Moving further along the graph, CDR needs to extend beyond 2050 to enter net-negative emissions. You can think of CO2 in the atmosphere like water in a bathtub that is overflowing. To feel comfortable again, you need to 1) stop the water inflow and 2) let water out so that the water level is reduced to your desired height.

For these reasons, human-made carbon removal (i.e., additional carbon removal to what we already have) is deeply needed to keep 1.5°C or even 2.0°C alive. CDR at the scale required (7 to 9 Gt CO2) would be a huge global undertaking as few industries move as much physical mass (e.g., global steel production is ~1.9 Gt).

Should we bother reaching that? Yes! Limiting global warming to 1.5°C is in our best interest as crossing this threshold could trigger multiple climate tipping points (e.g., Greenland ice sheet melting) that would lead to irreversible change in the climate system.5 If you want to learn more about those, check out this video about the tipping risk of the Atlantic Meridional Overturning Circulation (AMOC), one of the most ominous risks for Europe. We can highly recommend watching it. Give it a go after dinner tonight :) TL;DW the risk is larger than we thought.

Accordingly, climate scientist Johan Rockström (Director of the Potsdam Institute for Climate Impact Research) states: “1.5°C is not a goal or target. It is a physical limit. We should do everything we can to hold this climate planetary boundary.”6

Climate change will have economic effects too. Even if emissions were drastically cut today, the world is already committed to an income reduction of 19% compared to an economy without climate change by 2050. Limiting global warming is about 6x cheaper than not doing so.7

Takeaway: Yes, we need CDR. It is an addition to emissions reduction and crucial to limit global warming. Limiting global warming is cheaper than not limiting it.

2. Which options do we have for CDR?

The whole concept of CDR might seem quite abstract at first but it is incredibly interesting when you learn about it and dive deeper!

As briefly stated in the definition, CDR has three key characteristics/principles:8

The CO2 captured must come from the atmosphere, not from fossil sources

The subsequent storage must be durable, such that CO2 is not soon reintroduced to the atmosphere

The removal must be a result of human intervention, additional to the Earth’s natural processes

This is important to understand as CDR must be distinguished from the related terms carbon capture and utilization (CCU) and carbon capture and storage (CCS) that you might have heard of. CCU and CCS are used to capture CO2 from fossil carbon (e.g., from a gas power plant) to use or store it and do not necessarily result in durable carbon dioxide removal from the atmosphere. The illustration below shows four examples to better understand the differences.

Graph: CDR principles in action9

A: CDR! A machine captures CO2 from the atmosphere and it is stored in a geologic reservoir.

B: No CDR! Carbon dioxide is captured from the atmosphere but used for a short-lived product (fuel). The fuel is carbon-neutral but the process cannot be considered CDR as the CO2 will soon be in the atmosphere again.

C: No CDR! Carbon dioxide is captured from fossil carbon and stored geologically. This does not remove CO2 from the atmosphere.

D: It depends! Trees (and other biological forms) absorb carbon from the atmosphere and store it biologically. The example on the left cannot be considered CDR as the tree would have removed carbon anyway. The example on the right is CDR because human activity increased the amount of trees. The removal is additional.

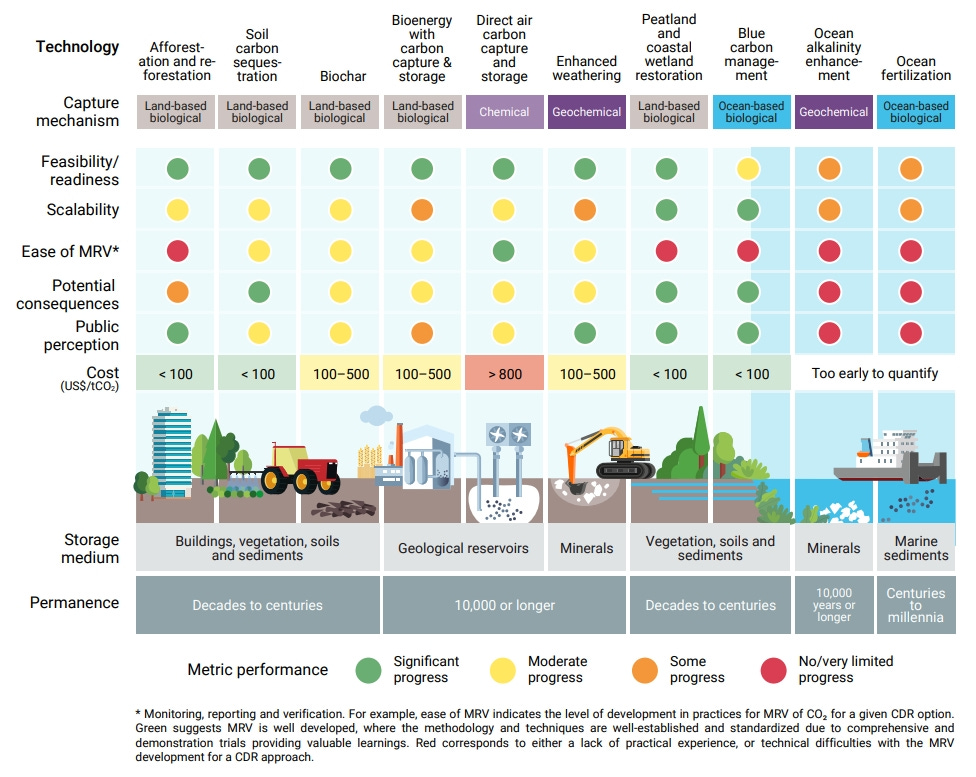

Now that we understand what CDR is, let us take a look at the methods to do it. There are four different capture mechanisms for CDR: land-based biological (e.g., planting trees), ocean-based biological (e.g., growing seaweed), chemical (e.g., using machines to filter CO2 from the air), and geochemical capture (e.g., grinding and spreading rocks that bind CO2). All of them have different characteristics as illustrated below.

Graph: Overview of CDR methods and their main characteristics10

Key criteria for evaluating CDR are 1) technological readiness, 2) scalability potential, 3) ease of measurement, reporting, and verification (MRV), 4) potential consequences (positive co-benefits but also negative side effects), 5) public perception, 6) costs, 7) storage medium, and 8) permanence.

Removing CO2 from the atmosphere is quite difficult because it is very dilute (0.04% atmospheric concentration). For example, this means that 99.96% of the air sucked in via the chemical method of direct air carbon capture and storage (DACCS) is not needed. This leads to high energy demand and high costs. Capturing 1 Gt of carbon dioxide via DACCS could use 2% to 4% of the total electricity supply in 2050 (including efficiency improvements).11 Benefits on the other hand are high measurability and permanent storage. Opposite to DACCS, most land-based biological approaches are efficient and thus relatively cheap in capturing carbon. Their drawback is that MRV is a lot more difficult.

The key learning here is that there is no silver bullet for CDR and that we should pursue all of these methods to build a portfolio of CDR. We see lots of innovation across approaches and believe that the next few years are about finding what works best to then scale it massively.

Where do we currently stand? Let us look at the split between conventional and novel CDR. Conventional or nature-based CDR includes most land-based biological CDR such as afforestation, soil carbon sequestration, and peatland and wetland restoration. Novel or technology-based CDR includes biochar, bioenergy with carbon capture and storage (BECCS), and ocean-based biological, chemical, and geochemical approaches. >99% of current removals (~2 GtCO2/year) come from conventional methods, principally through afforestation/reforestation. Novel methods only account for 1.3 million tonnes of CDR (0.0013 Gt) per year.12 The following graph shows that split quite clearly.

Graph: Current amount of CDR per year13

As a portfolio approach to CDR is needed, novel CDR needs to grow more quickly. Biochar and BECCS currently account for the largest shares of novel CDR. Biochar is a charcoal-like substance made by heating biomass in a controlled process called pyrolysis. It is mostly applied on agricultural soil to enhance its properties but can also partially replace cement in concrete production. BECCS refers to power plants producing electricity from biomass (e.g., biogas) while capturing and storing the CO2 from that process.

Due to text length constraints (you do not want to get a PhD right away, do you?), we will not go into greater detail about the ten CDR methods. If you do want to learn more, check out detailed descriptions here.

Takeaway: CDR needs to adhere to three key principles and there is a variety of CDR methods. They have different characteristics and we need to find out what works best at scale.

3. Who is going to pay for it?

Carbon dioxide removal would not exist without the voluntary carbon market (VCM). It is where almost all of the current demand for CDR comes from. The VCM allows emitters (mostly businesses with net-zero targets) to voluntarily support emissions reduction (e.g., clean cooking stoves), avoidance (e.g., avoided deforestation), or removal projects (e.g., afforestation). The VCM is far from perfect and has an image problem (see here) as many projects (e.g., avoided deforestation) never materialized in the past.

It is important to understand that CDR may be different as it only refers to a fraction of the VCM. Just 11% of credits in the voluntary carbon market are from carbon removal projects (4% novel CDR, 7% conventional CDR).14 Many dedicated individuals are working for transparent and high-quality CDR on the VCM (see Robert Höglund and CDR.fyi), which is great to see.

As of July 2024, 11 million tonnes of CDR have been sold for USD 3 billion in total. 2.9% of CDR has been delivered as most sales are pre-purchases for delivery in the future. Thereby, the VCM plays an instrumental role in deploying novel CDR. Novel CDR suppliers would not be able to survive and deploy their technology without those pre-purchases. Buyers mostly have low-emissions profiles, relatively high margins (e.g., software & services), and are willing to pay high prices for carbon removal (up to USD 2,000 per ton). Microsoft has bought 73% of all CDR to date and dominates demand. Other important buyers are Frontier (e.g., Stripe, Shopify, McKinsey, J.P. Morgan) and Milkywire who review and buy CDR on behalf of their members. For example, Frontier buys USD 1 billion of CDR between 2022 and 2030.15

CDR will become a large industry if it is going to scale to the required amounts for climate targets. The global market size could reach EUR 470 to 940 billion annually by 2050 in a 2.0°C and a 1.5°C scenario (4.5 Gt and 9 Gt of CO2), respectively. This is equivalent to the market size of today’s global airline industry.16

However, BCG estimates that VCM demand would only cover up to 0.75 Gt by 2050 (EUR 75 billion if you assume a price of EUR 100/ton). Thus, barriers to scaling CDR demand are unlikely to be overcome without governmental policy demand drivers. However, even when including proposed and existing policies, total CDR demand falls short of scientific requirements and only reaches 0.5 Gt to 2.5 Gt by 2050. The graph below shows that assessment by BCG.

Graph: Potential CDR demand in 2050 modeled by BCG17

Demand in 2050 could come from 1) the VCM, 2) standards and requirements, and 3) carbon pricing mechanisms. The latter two are policy interventions and could account for ~0.8 Gt and 1.25 Gt per year, respectively. For example, aviation could be required to counterbalance unavoidable emissions with CDR (~0.4 Gt demand by 2050).

Carbon pricing could include the integration of CDR into emissions trading schemes or border carbon adjustments. Border carbon adjustments are designed to make the carbon price of imports equivalent to the carbon price of domestic production. For example, EU importers will have to buy carbon certificates to import certain goods covered by the EU Carbon Border Adjustment Mechanism (CBAM) starting in 2026.18

Overall, CDR growth is catalyzed by the VCM but a large gap remains between expected levels of carbon dioxide removal and what is needed to meet temperature goals. The CDR gap is not a fixed quantity but a range that includes uncertainty. It is 0.9 to 2.8 Gt CO2 per year in 2030 and 0.4–5.4 Gt CO2 per year in 2050.19 It might even be much larger as emissions reductions are too slow and thereby increase the need for CDR even more.

Takeaway: The VCM is essential for CDR but will not be enough. CDR is not a product that people want to buy. The majority needs to be forced to, regardless of how cheap it is.

4. What is the largest lever to scaling CDR?

Policymaking and governance are the largest levers to scaling carbon dioxide removal and there are various forms to implement it. Ideally, policy 1) sets CDR goals, 2) pushes innovation, 3) aids in MRV, and 4) generates demand.

Goals: 150+ countries have proposed net-zero emissions targets since the adoption of the Paris Agreement to limit global warming to well below 2.0°C. Unfortunately, few countries have developed the necessary strategies for CDR that will be needed. Countries like Germany and Sweden (EU as well) are front runners in developing strategies for CDR. For example, the German government recently lifted its ban on offshore CO2 storage and may allow states to decide about onshore CO2 storage individually (see this).

Innovation: Support for R&D (14% yearly growth in grant funding) and demonstrations (e.g., USD 3.5 billion for Direct Air Capture Hubs in the USA) is increasing and has started showing a diversity of carbon removal methods. It is the most advanced of the four policy levers presented here. E.g., Germany supports CDR R&D with EUR 47 million across two programs called CDRterra and CDRmare.20

MRV: 102 MRV protocols exist and more standardization can be a step towards integrating CDR methods (mostly novel CDR) into climate policies, markets, and targets. It would also catalyze investment in R&D and early-stage CDR companies. For example, the EU is currently developing the EU Carbon Removals and Carbon Farming Certification (CRCF) Regulation. Additionally, the IPCC is working on a methodology report for CDR, CCS, and CCU planned for 2027 that will likely guide best practices in the VCM.21

Demand: As we saw above, more demand can be generated through carbon pricing mechanisms and sector-specific requirements (e.g., in aviation). For example, the EU is currently evaluating an integration of CDR into its emissions-trading system EU-ETS. The Commission needs to present options for this integration to the European Parliament and Council by 2026.

The 2nd edition of “The State of Carbon Dioxide Removal” report is built around the innovation process of CDR and provides an excellent in-depth perspective if you want to dive deeper into all things policy. Policymaking and governance influence many of CDR’s supply and demand factors as illustrated below.

Graph: Innovation and feedback relationships in CDR22

Let us briefly take a look at sequencing CDR into emissions trading systems. The EU-ETS is Europe’s most effective instrument in reducing greenhouse gas emissions. It covers the energy sector, manufacturing, and aviation. As of April 2024, ETS emissions are ~47% below 2005 levels and on track to achieve its 2030 target of -62%.23 This is great!

Researchers have modeled an integration of CDR into the EU-ETS and it looks like this:

Graph: Illustrative integration of CDR into the EU-ETS24

Phase 1: CDR removal firms start offering certificates as part of the EU-ETS in 2030 and will be the only provider from 2039 onwards when the EU stops providing new allowances (indicated by the dashed line “emissions cap”). Phase 2: Companies covered by the ETS with residual emissions after 2039 would then have no option but to buy from CDR firms. Phase 3: Direct government procurement is needed to reach net-negative emissions. Researchers find such an integration effective and it would cut allowance prices significantly:

Graph: Comparison of EU-ETS prices in 2030, 2040, and 205025

EU-ETS prices (also called EU Allowance (EUA) prices) in 2050 could be 47% lower when incorporating CDR. Surprising, right? While the results are great, high uncertainty about CDR costs and volumes remains.

Costs: Scenarios for EU-ETS prices show values of EUR 130 to EUR 160 per ton by 2030.26 CDR methods should then ideally fall into that range for companies to buy CDR already before 2039. See page 41 of this for an estimate of current and future costs across methods.

Volumes: CDR supply may be scarce and researchers urge companies not to bank on more CDR than they absolutely need for residual emissions.27

Overall, CDR policy receives more attention, but important policy and governance gaps (e.g., CDR goals) remain. One organization that does fantastic work towards closing those gaps is the German CDR industry association DVNE. Check out their work.

Takeaway: Policy is the largest lever to scaling CDR, especially for creating demand at scale. We see an evolving policy landscape but more ambition is needed.

5. What is on our CDR wish list?

Let’s take a look at our initial question: Will we ever see large-scale CDR? The answer is that we do not know yet. What excites us is that CDR is rapidly evolving. The key challenge is translating the scientific perspective that climate action (incl. CDR) has more benefits than costs into an industry with sufficient public, political, and investment support.

If we had one wish for CDR, it would be more ambition from policymakers and investors. There is an extraordinary community of researchers and founders that should see more support in developing, testing, and deploying their technology.

Graph: VC funding for CDR start-ups vs climate tech start-ups overall (NZI = Net Zero Insights)28

CDR funding picked up from USD 4M in three start-ups in 2013 to USD 1.5 billion in 131 start-ups in 2022. Huge growth! Sadly, CDR funding decreased more strongly (-43%) than overall climate tech funding (-14%) from 2022 to 2023.29 Irrespective of that, analysis by PwC shows that CDR is the only category of climate tech to see an absolute increase in investment over the past two years.30 So there is momentum! We would love for CDR investment to pick up again and spread more broadly across methods.

At Aurum Impact, we believe that CDR suppliers will capture a large part of the industry’s value and we are continuously looking for investments in the space. For new investments, we are excited about energy-efficient DACCS and approaches with promising MRV pathways across capture mechanisms. To date, we have invested in UNDO (enhanced weathering), The Landbanking Group (soil carbon sequestration), and in carbon removal fund Counteract (18 portfolio companies) which invests at the pre-seed and seed stages. Learn more about Counteract’s work in their recent piece on CDR trends.

Speed and scale are the only currencies that count for climate change mitigation! Let us collaboratively work towards high-quality CDR and exponential growth as previously seen in other industries (e.g., solar PV).

We would love to hear your thoughts! Reach out to jan.heihoff@aurum-impact.de if you want to chat or share a company that we should know about.

Aurum Impact is an impact investing firm backed by the Goldbeck Family Office. It empowers positive systemic change by investing in ambitious founders and impact funds across the focus areas of Circularity & Materials, Climate & Energy, Ecosystems, and Stable & Equitable Societies. Initial startup investments focus on Pre-Seed to Series A companies. Upon investment, Aurum Impact acts as a long-term and trusted partner across every stage and commits to longer investment horizons to allow founders and funds to flourish. The portfolio includes companies like UNDO, Cyclize, and Voltfang as well as the impact funds Planet A Ventures, Revent, and Systemiq Capital. Learn more at www.aurum-impact.de

Sources