Who finances impact hardware to scale?

Our CapEx Funding Database

The net-zero transition is the defining shift of our generation—and impact hardware startups play a key role. By 2050, nearly 50% of avoided CO2 emissions will rely on technologies that have not yet progressed past the demonstration stage.1 For example, global direct air capture capacity is at ~0.001% of the amount of carbon removal required under projections by the Intergovernmental Panel on Climate Change (IPCC).2

Scaling impact hardware often comes with steep capital expenditure (CapEx) requirements. Building manufacturing facilities, infrastructure, and production capacity demands significant upfront investment, especially for asset-heavy startups in hard-to-abate sectors.

Compounding this challenge is a glaring global funding gap: around $7 trillion annually is needed to close the shortfall in climate finance—nearly six times what’s currently available.3 For first-of-a-kind (FOAK) decarbonization and negative emissions facilities alone, an estimated $80-500 billion is required. Yet, less than 7% of this funding is available today.4

The consequences of these gaps are already clear. Take Northvolt, not too long ago hailed as a climate tech success story. Despite strong demand and billions in funding, Northvolt’s reliance on equity financing over debt to cover its CapEx needs likely played a role in its downfall. With earlier access to alternative types of finance, Northvolt might have focused more on profitability than valuation-driven growth, potentially avoiding its eventual collapse.5 The lesson is clear: we must rethink how we finance asset-heavy businesses to scale critical climate technologies. The challenge is finding and receiving the right balance among equity, debt, and other funding sources.

To address this, Aurum Impact, Celsisus Industries, and Planet A Ventures teamed up to create a public funding database—a collaborative tool designed to connect impact startups with CapEx funding opportunities. Find it here, and dive into the sections below to explore our thinking behind it.

1. Does hardware investing make sense?

Impact hardware startups are both incredibly exciting but also incredibly complex. They face structural challenges compared to software startups: 1) lower margins make organic growth more difficult as free cash flows are lower, 2) higher capital requirements exist at the early stages of their life cycle, 3) more time is needed to break even and scale up, and 4) there is greater commercial uncertainty.67

Despite these challenges, impact hardware holds the potential for outsized impact and financial returns. For example, solar PV is a massive and unstoppable success story. It provides the cheapest electricity in history and continuously outpaces capacity addition estimates.8 One former startup profiting from that is Enphase Energy, a leader in solar microinverter systems. The company was founded in 2006, went public in 2012, and has a market cap of $10 billion today. We firmly believe that other impact technologies have the potential to follow solar’s path as the first exits in nascent sectors begin to appear. For example, Occidental Petroleum bought direct air capture company Carbon Engineering for $1.1 billion in 2023.9

From an asset management perspective, investing in impact hardware also makes clear strategic sense. Research shows that ~40% of global equity valuation could be at risk due to physical damages from climate change.10 Impact hardware advances climate change mitigation and lowers the risk of climate damages affecting existing portfolios. Any long-term investor should have an inherent interest in funding impact hardware.

2. Who finances what?

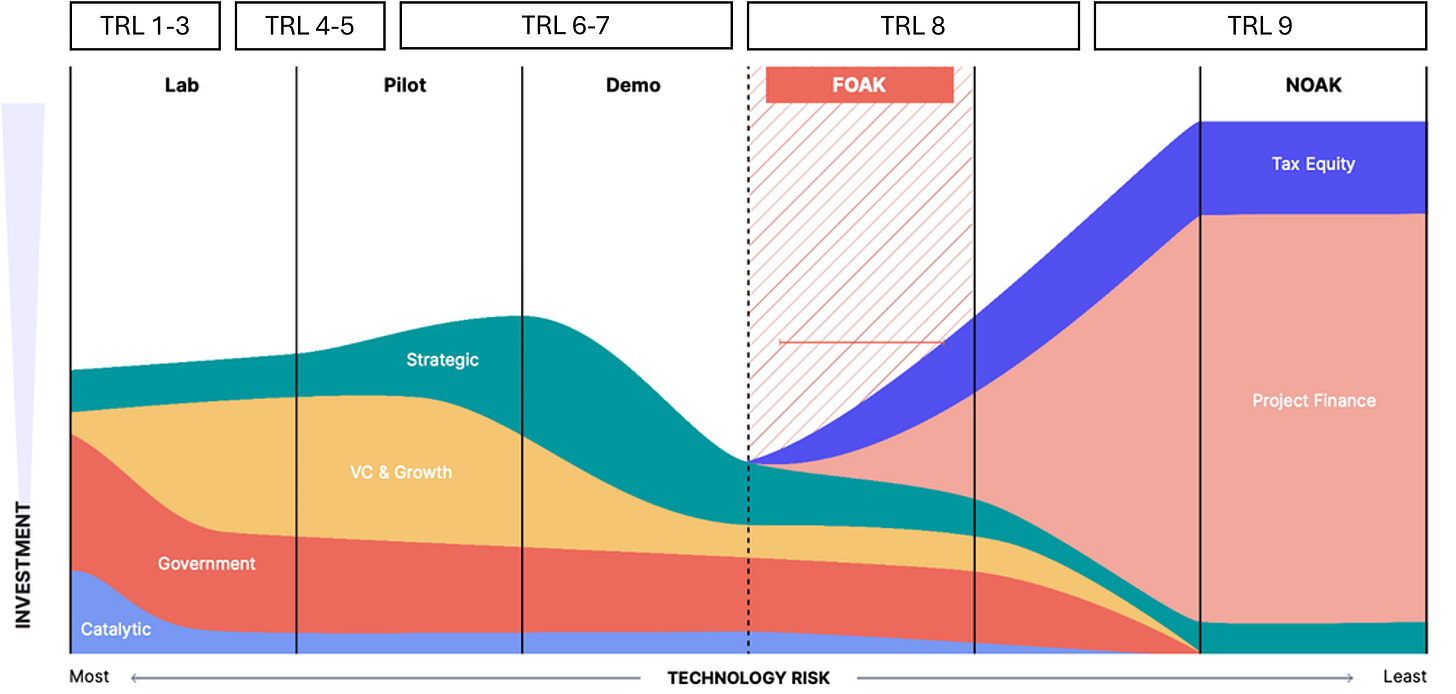

We use the concept of technology readiness level (TRL) in this article to group startup stages and investor focus. The TRL assesses the maturity of a technology moving from research through development to deployment. CapEx is needed at all TRLs but increases the larger the plants or manufacturing facilities become. As a result, different money pots are available at different TRLs. The graph below maps capital availability against project stage (TRL):

Graph: Capital availability against project stage (adapted from Sightline Climate)11

Catalytic and government money (e.g., ARPA-E (USA), SPRIND (Germany), CarbonFix) finance most of the research phase (TRL 1-3). From there, VCs and strategic investors step in to provide a large share of financing to move from prototype (TRL 4-5) through to pilot and demo stages (TRL 6-7). After that, there is a mismatch between the VC model (looking for a home run) and project finance (playing it safe). Thus, the largest CapEx financing gap emerges at ~TRL 8 when startups need to build first-of-a-find (FOAK) plants to prove industrial scale. At this stage, the capital required exceeds what VCs traditionally provide, while the high risk makes it difficult to secure project finance. (Learn more about the hurdles to accessing project finance here.) Once startups reach TRL 9 and move to nth-of-a-kind plants—replicas of the FOAK plant—project finance takes over and dominates.

In recent years, there has been growing attention on the capital stack across stages, and it continues to evolve. Today’s landscape includes a diverse set of players—government bodies, philanthropic organizations, family offices, early-stage and late-stage VCs, private equity firms, infrastructure specialists, and banks. Additionally, novel investors have begun to emerge who blur the lines between asset classes. For example, Australian Wollemi Capital launched in 2021 as a specialist climate investor. Rather than raising a fund, Wollemi pooled money on its balance sheet that can be invested flexibly across capital types.

To help founders navigate this complex funding ecosystem, we’ve created a snapshot of the most relevant CapEx investors they can reach out to as their companies mature along the TRL.

3. What type of capital is available?

The availability of capital changes as startups move through the TRL stages, both in terms of capital type and investor type. We distinguish between dilutive capital and non-dilutive capital. Dilutive capital refers to equity investments, where founders and existing investor see their ownership percentage decrease as new investors come in. Non-dilutive capital refers to debt and grants, where startups do not need to give away ownership. However, they need to be able to generate sufficient revenues over time to pay back the debt.

Generally, equity is more readily available for startups than debt. Equity is also available much earlier and can be received at any TRL. Debt has more requirements, which makes it difficult for startups to access it before getting to a certain stage. Grants are available throughout all TRLs, though availability strongly depends on geography and technology.

In addition, there are different legal entities through which equity and debt can be raised. Startups typically start financing their plants, such as a pilot plant, on the balance sheet of their company, which we call “TopCo”. Later, they might set up special purpose vehicles (SPVs) for specific projects, raising money solely for the given project. We call this “Project-Level” financing.

As a result, we have included five types of capital in our database: Equity (TopCo), Equity (Project-Level ), Debt (TopCo), Debt (Project-Level), and Grants & Public Funding.

4. What are the requirements to access different types of CapEx funding?

While some startups can access debt to finance the deployment of established technologies, like battery energy storage systems (BESS) and solar PV, others require significant equity to finance the production of novel hardware. For example, Zolar raised €100M in debt this year from BNP Paribas to deploy solar PV, which is at TRL 9. On the other hand, Reverion raised $62M this summer by combining dilutive and non-dilutive capital to produce its modular biogas power plants, which are not yet at TRL 9.

Ultimately, accessing different types of capital depends on the level of risk a startup faces, which in turn dictates the types of investors willing to commit. Key risk factors include technological risk (i.e., TRL), economic risk (i.e., selling into an established market; scaling tech in line with the business plan), operational risk (e.g., supply chain disruptions), regulatory risk (e.g., permitting), liquidity risk (i.e., factors influencing the runway), and management risk (e.g., experience and skill set of the team).

Banks, for example, typically want limited technological risk, an established market and fixed business model, offtake agreements for the product, limited regulatory risk, and guarantees (i.e., a third party promising to repay the debt if the startup fails to do so). Guarantees are crucial for unlocking more CapEx financing for impact hardware startups. Public financial institutions, such as the European Investment Bank, and insurance companies play a key role by providing these credit guarantees. To dive deeper, read this publication about public credit guarantees by Tech for Net Zero.

In general, the requirements to access CapEx financing differ by industry and stage. So, it's important to identify potential investors and capital types early on to engage about company-specific risks and the resulting requirements for investors to provide capital.

5. How to prepare for FOAK?

Securing funding for FOAK plants can be particularly challenging. However, there are a few key elements that can help make the process smoother, which CTVC refers to as “The Five P’s of FOAK Preparation”:

People: You’ll need 1) a project manager/developer, 2) a project engineer, and 3) a commercial director/COO.

Pilot: You have to show that the technology works and that the replication risk at the industrial scale (FOAK) is not too high. For example, modularity can help reduce that risk.

Plan: A solid plan should include 1) a techno-economic-assessment (TEA), 2) a life cycle assessment (LCA), 3) location options and permits, and 4) a clear path to bankability.

Partners: You need to secure 1) feedstocks, 2) offtakes (ideally take-or-pay at FOAK; Extantia and HV Capital do great work here—check their offtake database here), 3) an engineering, procurement, and construction partner (EPC) to lock in project costs, and 4) the right people on your board.

Persistence: Building a FOAK plant is a marathon, not a sprint—it takes time.

Once prepared, there are different ways a financing round at the FOAK stage can play out. CTVC defines five categories: 1) a super round of equity by VCs, 2) a round led by philanthropic/catalytic capital, 3) a round by led strategic investors, 4) a round led by government funding, or 5) a project-level raise combining equity and debt. Each option has different levels of transaction costs, dilution, scalability, and likelihood, as shown in the graph below.

Graph: Characteristics12 of FOAK round types by Sightline Climate

For instance, a super round might have low transaction costs but could come with high dilution and pressure on the company to prioritize growth over de-risking. This may have been the case for Northvolt. On the flip side, raising too much debt relative to expected revenues can create problems when the time comes to pay it back. If a startup ends up having to use equity to cover its debt payments, that’s not a good use of funds.

In short, preparing for a FOAK round requires a holistic approach. It’s crucial to balance scaling technology with strong unit economics and managing investors’ return expectations. For founders, thinking about capital needs and financing options early on is key. Fundraising is a long process, and having a clear strategy on 1) how to access both dilutive and non-dilutive financing and 2) how to mix them effectively will be essential for long-term success.

6. What are examples of funding rounds involving CapEx?

As startups progress through the TRL stages, the types of funding they secure evolve. Here are a few examples of funding rounds, ordered by round size:

Brineworks: €2M equity round led by Pale Blue Dot to advance a seawater electrolyzer that extracts CO2 and H2.

Cyclize: €4.75M equity round from UVC Partners, HTGF, Aurum Impact, UnternehmerTUM Funding for Innovators, and business angels to build and operate a waste-to-synthesis gas demonstration plant.

Phlair: €14M Seed round combining equity from Extantia, Planet A Ventures, and Verve Ventures with a €2.5M grant from the EIC accelerator to work on two 260 tCO2/year direct air capture (DAC) pilots in the Netherlands and Canada.

Paebbl: $25M equity round raised from Capnamic, Amazon's Climate Pledge Fund, Holcim MAQER Ventures, Aurum Impact, and others to build a demo plant for producing CO2-storing supplementary cementitious materials (SCM) for the construction industry.

Traceless: €36.6M Series A round combining equity from PE firm UB FIGG with a local banking syndicate consisting of GLS Bank and Hamburger Sparkasse to build a FOAK plant for a bio-circular alternative to plastic.

Heirloom: $150M Series B equity round led by VCs (Future Positive, Lowercarbon Capital) and complemented by strategic investors (H&M Group, Japan Airlines, Mitsubishi Corporation, Siemens Financial Services) to drive down the cost of their DAC technology, develop projects, and secure the resources needed to access infrastructure capital.

Twelve: $645M funding round combining $200M Series C financing and $400M project equity, both led by TPG Rise Climate, plus $45M in credit facilities ($25M construction loan by Fundamental Renewables and $20M green loan by multinational bank Sumitomo Mitsui Banking Corporation) to build a FOAK plant that transforms CO2 into jet fuel and e-chemicals at scale.

Stegra (fka H2 Green Steel): €4.75bn round combining €4.2bn in project-level debt, €300M in equity, and a €250M grant from the EU Innovation Fund to build the world’s first large scale green steel plant in Northern Sweden. The debt comes from over 20 lenders, including €3.5bn in senior debt and up to €600M in junior debt, with guarantees of €1.2bn from Riksgälden (Swedish National Debt Office) and Allianz Trade (fka Euler Hermes).

Where to go from here?

In the past couple of years, some excellent resources have emerged that go deeper into these topics. If you have not already, we highly recommend checking out the FOAK series by CTVC and the Climate Hardware Playbook by Planet A Ventures, Norrsken, and Speedinvest.

Additionally, the U.S. Department of Energy has developed a concept called Adoption Readiness Level (ARL), which combines TRL with elements like value proposition, market acceptance, resource maturity, and license to operate. They have a great ARL assessment template you can find here .

Another notable initiative called Mark1 was launched by RMI, Deep Science Ventures, and Third Derivative this year. It is designed as a Developer-as-a-service for CapEx-heavy industrial climate technologies. Applications open on 13 January 2025.

Our CapEx Funding Database

We have created a CapEx Funding Database as starting point to identify suitable capital providers and start conversations early. If you’re a founder, take a look at the list and let us know what you think. If you are an investor and find yourself or others missing, please feel free to extend the list with additional entries here.

Further readings

Aurum Impact, Celsius Industries, and Planet A Ventures: CapEx Funding Database

Planet A Ventures, Norrsken, Speedinvest: Building and Scaling Climate Hardware: A Playbook

Planet A Ventures: Project Finance Template: How to master your climate capital stack

Extantia & HV Capital: Public Offtake Directory

Extantia: The Traditional Funding Cycle Doesn’t Work for Climate Tech; The FOAK Question: Essential Insights for Financing and Planning First-Of-A-Kind plants;

Builders Vision: The Vital Role of Family Offices in Scaling Innovations to Drive the Future

Tech for Net Zero: Public Credit Guarantees

U.S. Department of Energy: Adoption Readiness Levels (ARL) Framework

CTVC: What the FOAK?, FOAK I (Venture to Project Finance Duolingo), FOAK II (FOAK Checklist), FOAK III (Five funders & formulas), FOAK IV (From FOAK to NOAK)